FAQ- Life Settlements

What is a Life Settlement?

A Life Settlement is a legal option that life insurance policy owners have that most are unaware of. It allows the policyowner to sell their policy, which is actually an asset, to a buyer. In addition to getting cash from the buyer, the policyowner will have no more premiums to pay and forfeits ownership of that policy. The buyer now owns the policy and can profit from the death benefit when the original policyowner dies. That said, it is possible to work out an arrangement where the original policyowner keeps a portion of the death benefit for his/her own beneficiaries.

What are the Pros and Cons of Selling my Life Insurance Policy?

Pros – You get money to take care of urgent or unexpected needs. You have no further premiums to pay. There are plenty of eager buyers for qualified policies, which means you can get increasing bids for your policy. If desired, you may keep some or all of the death benefit when you die, depending on how the life settlement agreement is established. There are no out-of-pocket costs for quotes or the transaction. You can use the money for any purpose.

Cons – You give up ownership and possibly some or all of the death benefit of the policy, and there can be tax ramifications on cash received above the premium you paid into the policy.

Are Life Settlements Regulated?

Yes. Like life insurance laws, most states have regulations regarding life settlements and over 90% of policyholders are protected by such. Additionally, LISA (Life Insurance Settlement Association)and other industry associations have requirements, regulations and industry standards that govern members and protect the original policyholder from fraud or identity theft.

Are Life Settlements legit or are they scams?

Life Settlements should not be associated with illegal or marginally legal practices like STOLI (aka: Stranger-owned Life Insurance.) They are highly regulated and monitored by each state. Make sure to work with properly licensed brokers and do not divulge your information to any entity which may call you out of the blue and ask about your policy details. The broker you hire should be properly licensed and transparent, and all documents transferred securely whether my mail or online. This creates a paper trail and fiduciary responsibility.

Why would anyone want to buy my policy?

Think of a Life Settlement this way: You have an asset (a policy,) and a buyer wants to purchase said asset. You need money or otherwise are about to give up, walk away from and/or surrender that asset. The buyer, using a legal Life Settlement, will pay you cash now and gets more money later on when you die (all or some of your death benefit.) It’s usually very lucrative and beneficial for both you and the buyer.

Can I look for buyers on my own?

Yes. However, you have little or no legal protection from unscrupulous buyers. Life settlements are highly regulated legal transactions. If you have not completed a transaction before and are not confident about navigating a life settlement on your own, seek professional help and use an experienced life settlement broker or get a referral from a trusted insurance agent. Both have a legal, fiduciary responsibility to act in your best interest. There is no cost or obligation to you.

Can I sell my small policy?

While most life settlements are arranged on policies with face-values of $100,000 or more, the lower limit is actually $50,000. So even if your policy is worth less than normal, the amount you receive in a life settlement may still provide needed funds and have an immediate impact on your financial situation.

Will my 10 yr Term policy qualify for a Life Settlement?

Term life policies can be sold only if they are “converted” into whole or universal life policies. Make sure to ask us if your Term life policy still qualifies for conversion and is outside of any lapse periods.

In most cases, when you turn age 70 you lose the ability to convert your policy to permanent, and thus cannot qualify for a life settlement.

Do I need to be sick to be eligible for a Life Settlement transaction

You do not have to be sick to pursue a life settlement. Viatical settlements, on the other hand, are designed for policyholders with a relatively short life expectancy. A traditional life settlement has no such requirement. If you are facing a terminal illness, there may be riders in your current policy you can get money from in lieu of a life settlement.

Is there an exam and a lot of paperwork?

No exam will be needed but the buyer will need to have access to your medical information to determine life expectancy. Most buyers prefer mortality to occur within 10 years, so the sicker and older you are the more you will receive. In terms of paperwork, besides ordering your medical records, new technology and direct policy buyers have made the process of life settlement transactions much, much faster.

In general, you can get an informal quote within 48 hrs. Depending on how long it takes to get your signed HIPPA (privacy )form, buyer bids, the review of your medical data and your acceptance of the final offer, you can get a formal offer within a week or so and the process can close within 3-6 weeks.

How much do Life Settlements pay?

This is determined by your age, your health, the type of policy and who you’re dealing with. Our team is dedicated to getting top dollar, but we’ll need your cooperation in terms of requested documents.

There are some examples below, but these will vary from policy to policy.

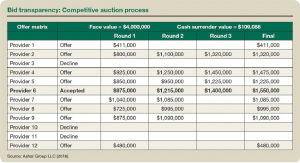

For a highly desirable policy, it is not uncommon to go through 10 to 15 rounds of bidding to generate 20 to 30 bids and incremental bid increases. The providers/buyers usually pay a substantially higher price to acquire the policy when a broker is involved than they would if the policy owner/seller works directly with a provider. The chart “Bid Transparency: Competitive Auction Process,” (below) shows an abbreviated bid matrix that demonstrates why CPAs need a life settlement broker to create competition and to ensure their clients have a licensed fiduciary to protect their best interests in the life settlement process.

Will it cost me to sell my policy?

Possibly, but not much. You may be responsible for document copying costs and postage when sending your paperwork to buyers for review. Other than that, any potential costs are usually absorbed by the buyer of your policy. Those costs may include document postage (if needed) and Term policy conversion to permanent, since you cannot sell a Term policy without first having it converted to permanent.

Can I look for buyers on my own?

Yes. However, you have little or no legal protection from unscrupulous buyers. Life settlements are highly regulated legal transactions. If you have not completed a transaction before and are not confident about navigating a life settlement on your own, seek professional help and use an experienced life settlement broker or get a referral from a trusted insurance agent. Both have a legal, fiduciary responsibility to act in your best interest. There is no cost or obligation to you.

Are there companies that buy life insurance policies?

Well, not life insurance companies. In a Life Settlement transaction, only individual buyers and investor groups put up all the money for your policy.

Are Life Settlements Legal?

Definitely, absolutely and you betcha.’ Life Settlements have been legal since 1911. The U.S. Supreme Court case of Grigsby v. Russell, 222 U.S. 149 (1911) established a life insurance policy as private property,or “an asset,” which may be assigned at the will of the owner. Justice Oliver Wendell Holmes noted in his opinion that life insurance possessed all the ordinary characteristics of property, and therefore represented an asset that a policy owner may transfer without limitation. Wrote Holmes, “Life insurance has become in our days one of the best recognized forms of investment and self-compelled saving.”

This opinion placed the ownership rights in a life insurance policy on the same legal footing as more traditional investment property, such as stocks and bonds. As with these other types of property, a life insurance policy could be transferred to another person at the discretion of the policy owner.

This decision established a life insurance policy as transferable property that contains specific legal rights, including the right to:

⦁ Name the policy beneficiary

⦁ Change the beneficiary designation (unless subject to restrictions)

⦁ Assign the policy as collateral for a loan

⦁ Borrow against the policy

⦁ Sell the policy to another party

Source: Wikipedia

Can I use the money from a Life Settlement to pay for nursing home?

Yes, you can use the money for any purpose with no restrictions.

How does selling my life insurance policy work? What are the steps?

⦁ You decide to sell for whatever reason that makes sense to you, then hire us ( at no cost to you) to represent you to buyers by formal agreement..

⦁ We discuss your options and make an informal offer after acquiring some basic information.

⦁ We acquire Medical records, do a mortality analysis and negotiate for the highest bids for your policy.

⦁ Upon receiving the highest bid, we get your final approval, finalize the agreement and change the beneficiary. Note: You don’t need to change the beneficiary, but you’ll receive more cash if you do.

⦁ You receive the cash formally agreed upon.

Should I sell my whole life insurance policy?

That’s up to you. Your circumstances and (lack of) finances will usually dictate whether or not selling your policy is a wise move. At times, it could also be a matter of if you still need to have coverage or not. Please discuss this with us if you need help.

How do you find the cash value of a life insurance policy?

The cash-value of your policy is the amount accrued during the life of your policy. However, it is NOT the same as the ‘Surrender’ value, which is the net amount you’ll get if you simply take the cash out without doing a Life Settlement. Additionally, the surrender value will be lower if you took out a loan without paying it back. With a Life Settlement, you can get 25% to 40% more cash than you can get from taking out the money yourself, and you’ll never have to pay premiums going forward.

Can you cash in a paid up life insurance policy?

Yes. However, using a Life Settlement transaction, in most cases you will get much more than the cash-value you’ve accrued in the policy. Depending on how the transaction is structured, this can happen whether you need to keep the full death benefit or not.

How much can you borrow from your life insurance policy?

You can borrow up to the current cash-value accrued in the policy. If you don’t pay it back, it will reduce both the cash-value and the death benefit.

What happens when you surrender a whole life policy?

You get the surrender value, which is the cash-value minus any fees, premiums or loans due, and you lose the death benefit. Please discuss with us before you walk away from your policy. We can show you smarter, more profitable options.

What happens when you surrender a Term policy?

Term policies accrue no cash-value, so unless you have a Return of Premium rider you will forfeit the entire policy coverage and get nothing back. You may have other options, so make sure to hit us up before you walk away from that policy.

How do I surrender my whole life insurance policy?

You can call your insurance carrier and walk away from it, or you can call us for smarter, more profitable options.

How is my surrender value calculated?

Surrender Value (with cash-value life insurance plans, only) = Cash-value minus fees, premiums due and any outstanding loans.

How can I get help/money paying my bills?

If you have a current, qualifying Term, Universal or Whole Life insurance policy, you can get cash, potentially lots of cash, if you decide you don’t need it and wish to sell it through a reputable and experienced life settlement broker.

How do I get emergency financial help?

If you have a current, qualifying Term, Universal or Whole Life insurance policy, you can get cash, potentially lots of cash, if you decide you don’t need it and wish to sell it through a reputable and experienced life settlement broker.

Is selling my life insurance policy a good idea?

It depends. Your circumstances and (lack of) finances will usually dictate whether or not selling your policy is a wise move. At times, it could also be a matter of if you still need to have coverage or not. Please discuss this with us if you need help.

Is selling my life insurance policy a bad idea?

That’s up to you. Your circumstances and (lack of) finances will usually dictate whether or not selling your policy is a wise move. At times, it could also be a matter of if you still need to have coverage or not. Please discuss this with us if you need help.

Why should I use Lifeguard Insurance to sell my policy?

Not only do we sell life insurance, but we know the value of it! Clients depend on us to be fair and transparent, and to get maximum dollars with multiple bids.